Credit scores are the financial gift that keep on giving. Or in some cases, that keep on hurting. While you have the power to change your credit score, it does take long term action on your part. If you’re trying to re-build credit at the same time that you’re trying to buy a house, your credit score will affect your mortgage and your interest rate.

So we know that we all want a good score. What does that look like?

We’ve talked about credit scores before, but just as a reminder here’s what they boil down to.

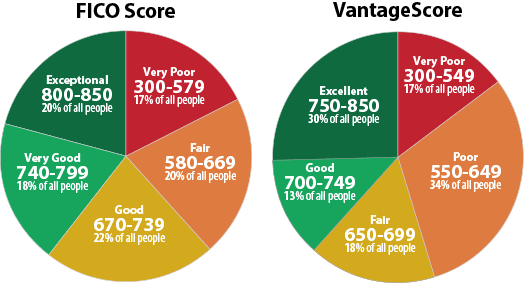

Technically speaking, you have more than one credit score. There are many companies that assess people’s credit usage and issue scores. The most commonly used score is one called a FICO score. Second most commonly used is the Vantage Score.

How Credit Scores Are Created

Credit scores are used to assess how capable and likely you are to make on-time payments on your lines of credit. A low score means you are a high-risk candidate for a loan, and a high score means you’re more dependable. How much debt you have, how much of your credit you use, and how often you make on time payments are all part of how your score is generated.

Knowing that a high score means you’re a dependable loan candidate means that we all want to be aiming for high scores. Here’s a breakdown of how Experian rates credit scores.

As you can see, 800-850 is the highest score ranking for FICO scores, and 750-800 is the highest for the Vantage score. Each company issues their own criteria for credit scores. Here’s what each of the ranges mean for these companies.

FICO SCORES

| Credit Score | Rating | % of People | Impact |

|---|---|---|---|

| 300-579 | Very Poor | 17% | Credit applicants may be required to pay a fee or deposit, and applicants with this rating may not be approved for credit at all. |

| 580-669 | Fair | 20.2% | Applicants with scores in this range are considered to be subprime borrowers. |

| 670-739 | Good | 21.5% | Only 8% of applicants in this score range are likely to become seriously delinquent in the future. |

| 740-799 | Very Good | 18.2% | Applicants with scores here are likely to receive better than average rates from lenders. |

| 800-850 | Exceptional | 19.9% | Applicants with scores in this range are at the top of the list for the best rates from lenders. |

VANTAGE SCORE

| Credit Score | Rating | % of People | Impact |

|---|---|---|---|

| 300-549 | Very Poor | 16.7% | Applicants will not likely be approved for credit. |

| 550-649 | Poor | 34.1% | Applicants may be approved for some credit, though rates may be unfavorable and with conditions such as larger down payment amounts. |

| 650-699 | Fair | 18.3% | Applicants may be approved for credit but likely not at competitive rates. |

| 700-749 | Good | 12.6% | Applicants likely to be approved for credit at competitive rates. |

| 750-850 | Excellent | 30.3% | Applicants most likely to receive the best rates and most favorable terms on credit accounts. |

Source

Your Personal Credit

Bad credit can’t be erased instantly, but understanding how your credit works and what you’re working towards is a good way to start rebuilding your credit.

If you already have good credit knowing how credit sores work is a good way to stay in the high ranges. Now that you have all the information on what good credit is, go forth and get a high score!

Looking for more great articles on how I handle my money? Try these articles:

Why I Have Trouble Spending Money

How I’m Paying Off That $1,200 Credit Card Bill

Kara Perez is the original founder of From Frugal To Free. She is a money expert, speaker and founder of Bravely Go, a feminist financial education company. Her work has been featured on NPR, Business Insider, Forbes, and Elite Daily.

Source

Source