Millions of Americans could receive much-needed financial relief this tax season in the form of waived penalties from the IRS. IRS Plan to Provide Relief for Taxpayers The IRS recently announced a plan to waive $1 billion in penalties for people and businesses who still owe back taxes from 2020 and 2021. The waiver will […]

Author: Haley White

Home Buying Hacks: Decoding the Right Mortgage for Your Dream Home

Explore the options for financing your new home and learn about how each mortgage could benefit you. Securing a Home Mortgage Buying a home is an exciting time. Most people don’t pay cash for their new homes, so they turn to banks and mortgage lenders to help them finance the purchase. Your home loan specialist […]

From Rock Bottom to Stellar: 5 Bold Moves to Fix Your Terrible Credit Score

If your FICO credit score is under 670, you’ll want to check out these tips for improvement. A higher score can help you finance big purchases and can even save you money. Here’s how. Is Your Credit Score Holding You Back? Are you considering a big investment in 2024 like a new car or house? […]

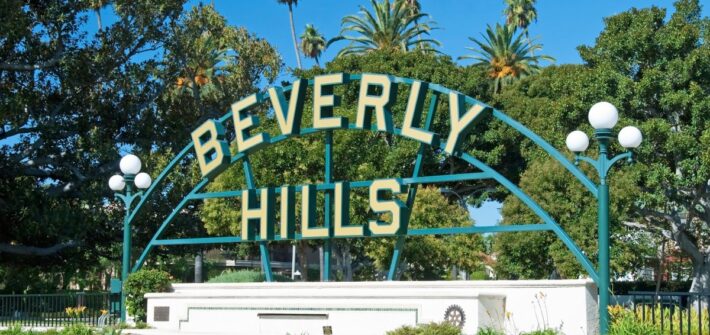

Affordable Housing Takes Priority: Judge Blocks Home Improvements in Beverly Hills

A judge in Beverly Hills has put a stop to luxury home improvements in the midst of a housing crisis, saying that more affordable housing in the area must come first. Upgrades Cost More Some Affordable Homes For homeowners in Beverly Hills, obtaining a building permit any time soon is going to be difficult. In […]

Unlocking Homeownership: The Low-Down on USDA Loans

Prospective homebuyers have many options when it comes to financing their new homes, but some loan types can offer the opportunity of homeownership to those who may not have a down payment saved. For those who qualify, USDA loans can be a great path to owning your home. What is a USDA Loan? USDA, or […]

Financial Tips for Gen Z: Navigating Credit Scores in 2024

As we move into 2024, the upper half of Generation Z are now in their early 20s, moving firmly into adulthood. The financial decisions they make now will impact their credit score into the future. Check out our roundup of credit tips for America’s newest adults. What is a Credit Score? A credit score is […]

2024 Homebuying Trends: Going Green, Opting for Smaller Spaces, Making a Big Difference

Real estate trends change frequently, but knowing what to watch for can help you decide when, where, and what to buy when the time comes. Sustainability is Key 2024 is likely to be a greener year for homebuyers, as climate concerns rise and clean energy becomes more of a priority. Buyers in 2024 want to […]

Understanding Banks vs. Credit Unions: Which Is Right for Your Money?

Deciding whether to use a credit union or bank can be a tricky process, but knowing what features are important to you in a financial institution is a great place to start. Considering Your Options If you’ve ever wondered whether banks or credit unions are a better fit for your money, it’s a good idea […]

How to Qualify for a Mortgage: Expert Advice

If you’re considering purchasing a home anytime soon, you may have wondered if there are any steps you can take to better position yourself for such a major financial move. The good news: there are some ways you can prepare. How to Know if It’s the Right Time to Buy In 2024, the housing market […]

How Millennials Can Score Their Dream Home in 2024’s Housing Market

The housing crisis in the United States has left many people in vulnerable situations, and millennials are feeling the brunt of its impact. There are options for homeownership even in a contentious market. The State of the Market It’s no secret that the housing market is struggling to recover after mortgage rates soared in 2023, […]