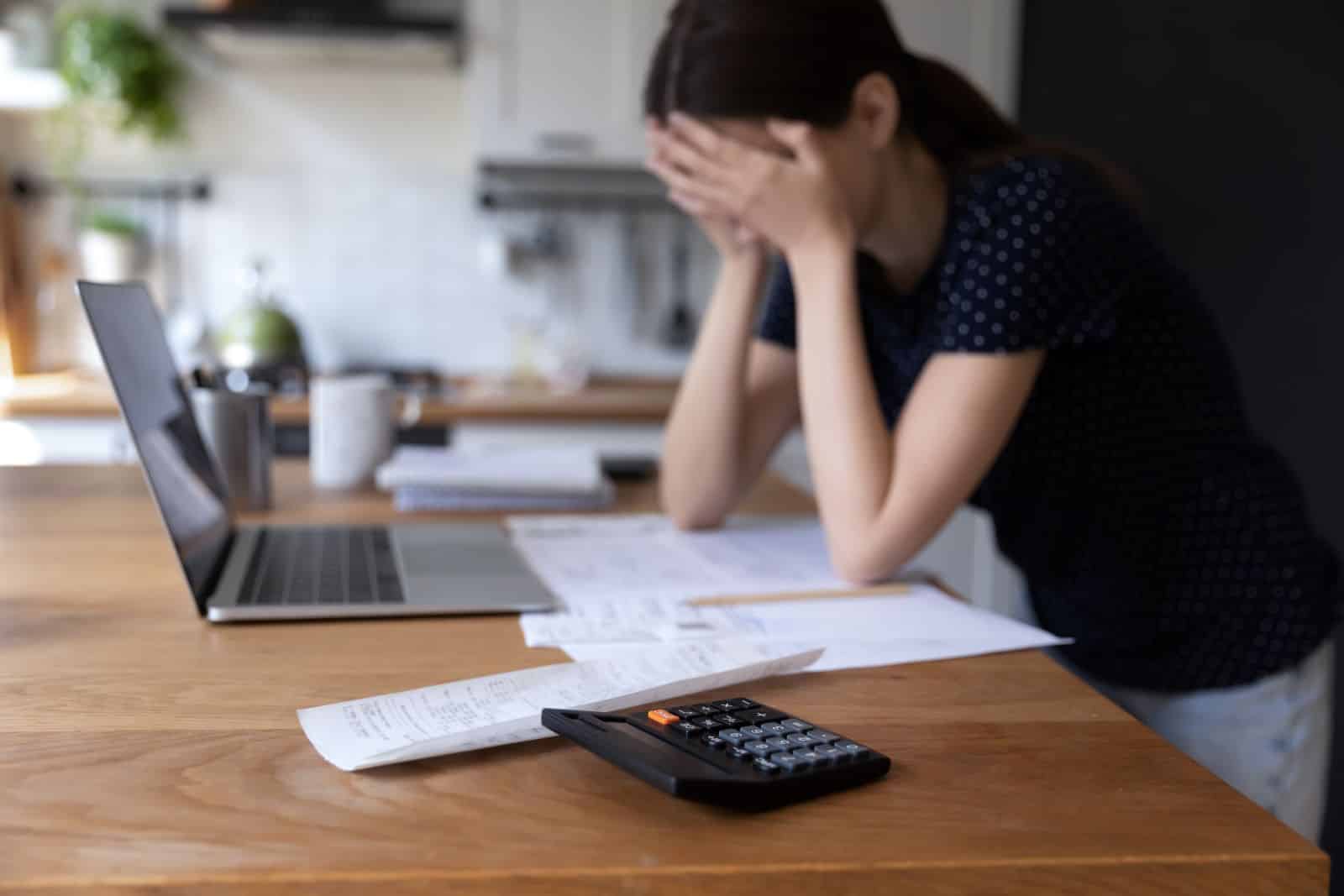

At the start of 2024, the U.S. grappled with economic expansion and strong job growth but unexpectedly high inflation. This economic challenge is hurting the Federal Reserve’s target of a 2% inflation rate and leaving it with few options.

2024’s Economic Start

The United States’ economic conditions at the start of 2024 initially showed signs that inflation was cooling and with the potential for moderate economic growth due to Federal Reserve interest rate hikes towards the end of 2023.

Missing the Landing

Unexpectedly, 2024 saw rapid economic expansion and strong job gains but failed to make much progress in reducing inflation and missing the economy’s anticipated “soft landing.”

A Difficult Position

Consistent and strong economic growth, combined with a painstakingly low reduction of inflation, has now put the Federal Reserve in a difficult position.

The 2% Goal

The Federal Reserve’s response to these challenges has been to highlight its goal to achieve a 2% inflation rate to maintain price stability and ease the economic burden facing many countries.

The High CPI

In early 2024, the Consumer Price Index (CPI) was released and showed the inflation rate to be much higher than expected, with around 3.8% annually when excluding food and fuel inflation levels.

Adapting Plans

With the CPI reading almost double the Federal Reserve’s target goal, it is clear that inflation has not been decreasing as expected, forcing the Federal Reserve to adapt its plans accordingly.

Two Cuts

In response to the situation, Federal Reserve Bank of Boston President Susan Collins expects that there may be two interest rate cuts in 2024 because a slowdown in demand will help hopefully bring down inflation.

No Guarantee

However, Collins also pointed out that the Federal Reserve has to do its best with the provided data, and they have no guarantee of knowing what its decisions may lead to.

Not Ruling at Increases

While not at the center of Collin’s predictions, she did say that she is not ruling out the possibility of rate increases if inflation does not decrease or increase.

No Crystal Ball

When discussing the situation, Collins said, “the data continues to be volatile and noisy and a lot of uncertainties,” but “we don’t have a crystal ball in terms of how things will come out.”

Questions Expectations

Despite 2024’s initial market predictions being positive, robust economic indicators like strong hiring trends and persistent inflation have led some economists to question expectations for rate reductions.

Biden’s Optimism

In 2023, President Joe Biden seemed very optimistic about rate cuts in 2024, predicting that there would most likely be a rate cut from the Federal Reserve by the end of the year.

Standing By the Prediction

Earlier this year, when asked about his previous prediction in 2023. Biden said, “I do stand by my prediction that, before the year is out, there’ll be a rate cut.”

Delaying Cuts

However, when the CPI revealed the high inflation rate in 2024, Biden seemed to waver in his position, stating, “This may delay it a month or so — I’m not sure of that.”

An Independent Reserve

Despite Biden’s optimism, Federal Reserve Chairman Jerome Powell emphasized the independence of the Federal Reserve from political pressures and election cycles during a recent speech.

Serving Long Terms

Chairman Powell said, “Fed policymakers serve long terms that are not synchronized with election cycles,” and “our decisions are not subject to reversal by other parts of the government, other than through legislation.”

Presidential Speculations

This information suggests that Biden’s hopeful predictions are nothing more than speculations since politicians have little influence on the Federal Reserve’s economic strategies.

Hiking Rates Again

Some Fed officials, like Governor Michelle Bowman, have suggested that if inflation conditions continue to worsen over the year, the Fed may even need to hike rates again.

Stall of Reverse

Governor Bowman said, “we may need to increase the policy rate further should progress on inflation stall or even reverse.”

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post – Inflation Woes Keep Federal Reserve from Reducing Interest Rates in 2024 – first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / FOTOGRIN.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.