Jamie Dimon, JPMorgan CEO, raises an alarming concern: America is dangerously high on a ‘sugar high’ of debt. He likens the current economic situation to a precarious addiction, demanding urgent attention.

Pandemic and Debt Surge

The pandemic era saw an enormous surge in US debt. Stimulus checks and Federal Reserve bond purchases injected trillions into the economy, creating an artificial boom that Dimon equates to a “heroin” effect on consumers.

A Dangerous High

According to Dimon, this debt-driven stimulus brought temporary prosperity but set the stage for long-term economic challenges. The influx of cash led to profit spikes and stock market highs, but these are potentially unsustainable.

Inflation and Withdrawal Symptoms

The Federal Reserve’s response to inflation – tightening monetary policy – may lead to what Dimon describes as a withdrawal phase. The economy, adjusting to reduced stimulus, faces potential volatility and instability.

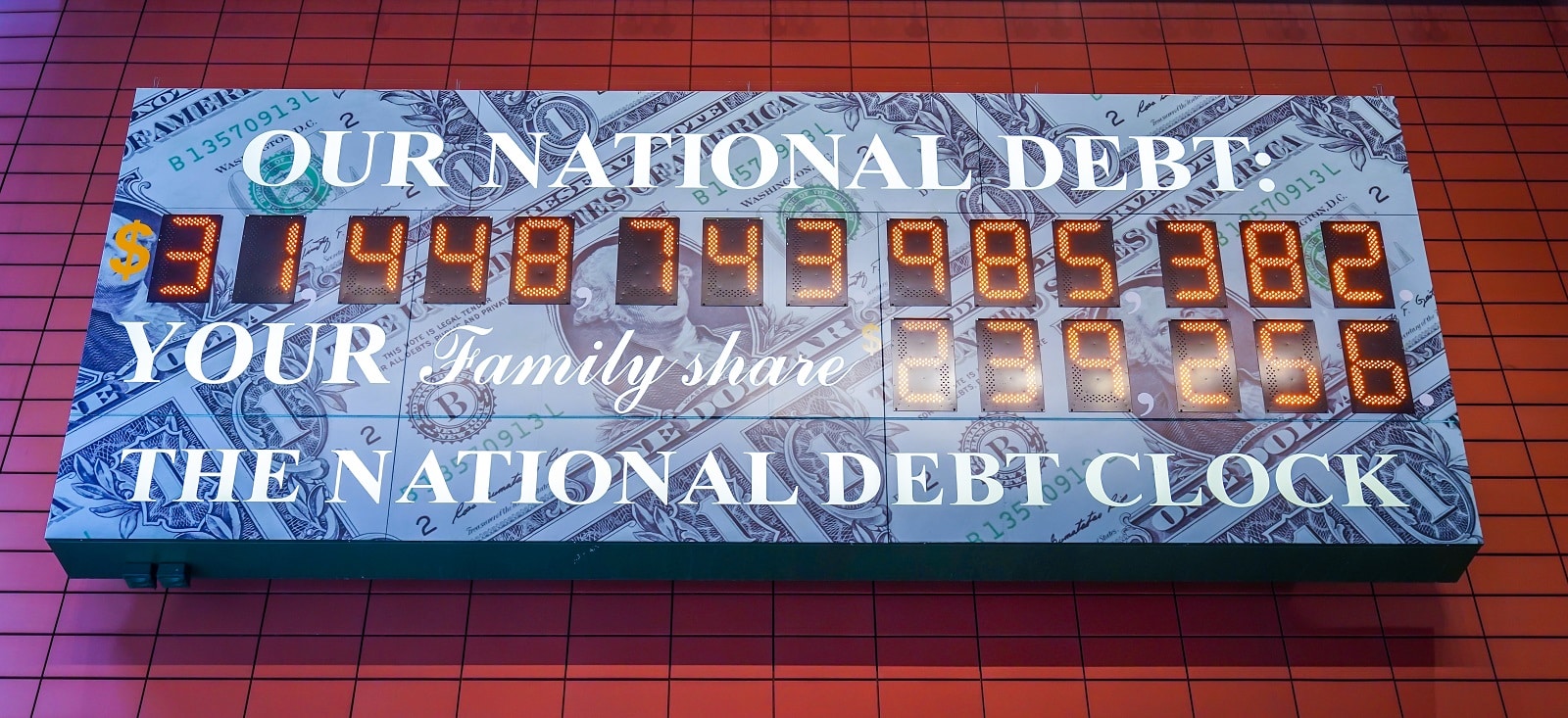

Record-High Debt

The US’s debt has skyrocketed, hitting a staggering $33 trillion. As debates continue over the federal budget, this number is inching closer to $34 trillion, a level of indebtedness with profound implications.

Inflationary Forces Linger

Dimon warns of persistent inflationary pressures exacerbated by high government spending. This situation could lead to increased interest rates and further economic complications.

A Crisis in the Making

Economists warn that if the U.S. doesn’t alter its fiscal path, it might face a debt crisis within two decades. A default on this debt could trigger catastrophic economic repercussions.

Global Risks

The US’s debt issue is part of a broader “cocktail” of global economic risks. Dimon has previously expressed concerns about the world facing its most dangerous period in decades due to multiple factors, including wars and restrictive monetary policies.

Implications for Consumers

The average American consumer, already grappling with inflation, might face more challenges. Rising debt levels could lead to increased borrowing costs and reduced economic growth.

Impact on Small Businesses

Small businesses, vital to the US economy, could suffer. With potential interest rate hikes and a tightening credit market, these businesses may struggle to access necessary capital.

The Stock Market’s Uncertainty

The stock market, which initially surged due to the debt-fueled stimulus, now faces uncertainty. Investors might see increased volatility and risk, impacting retirement funds and savings.

Government Spending Scrutiny

Government spending practices are under the microscope. With the national debt ballooning, there’s growing debate about fiscal responsibility and the need for sustainable spending policies.

Calls for Policy Change

Dimon’s comments underscore the need for policy changes. There’s a growing call for measures to address the debt issue before it escalates into a full-blown crisis.

The Fed’s Delicate Balance

The Federal Reserve faces a delicate balancing act. Its decisions on interest rates and monetary policy will significantly influence the economy’s path forward.

Looking Ahead

As America navigates this debt dilemma, the choices made today will shape the economic landscape for years to come. It’s a critical moment for policymakers, businesses, and consumers alike.

A Turning Point

The U.S. stands at a critical juncture. Addressing the debt issue requires a concerted effort from all sectors. It’s a complex challenge but one that must be met head-on to ensure long-term economic stability and prosperity.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post JPMorgan CEO Warns: U.S. Economy High on ‘Sugar High’ of Debt first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / lev radin.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.