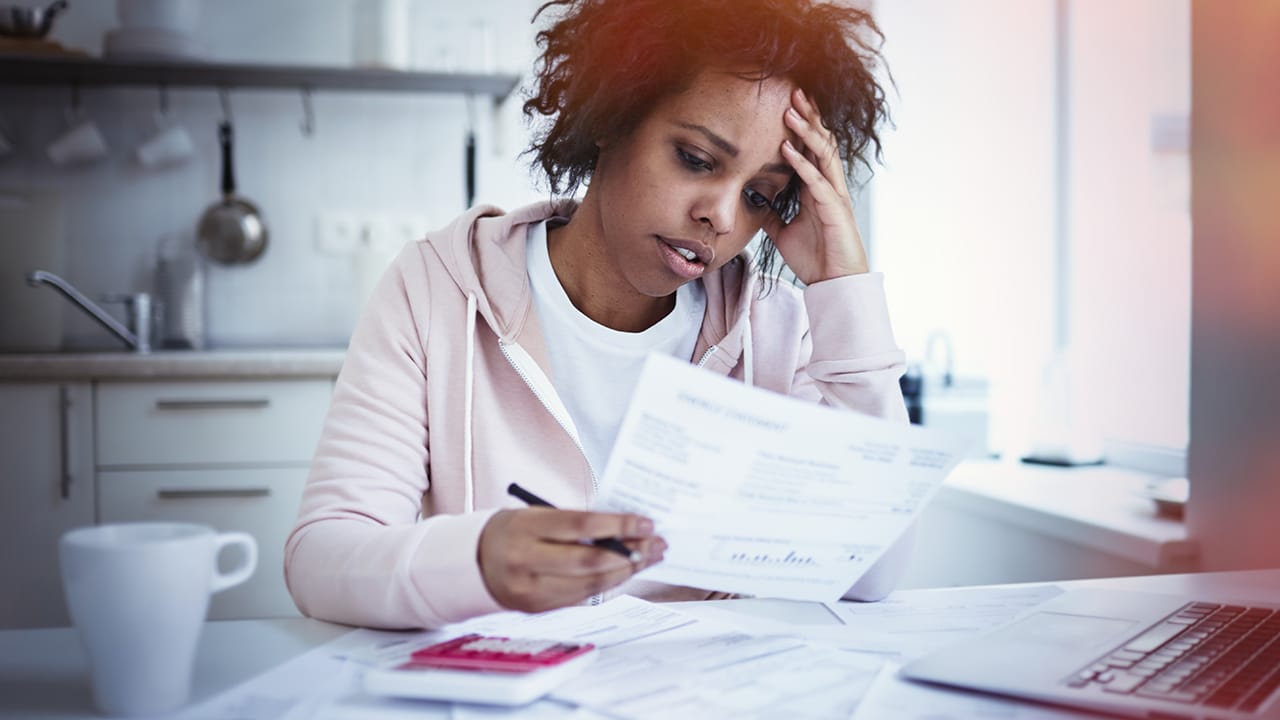

Many decisions that will affect our lives in the future are tied to our finances. The decisions we make concerning our money now will go a long way to shape our future spending power, which remains a fact, no matter how we want to look at it. It’ll be easier for us to accept this and adjust our lives accordingly than to continue to deny it and leave our finances to chance.

Indeed, we can not entirely predict the future. But taking charge of the small things we can control now can go a long way in deciding that future. We may choose to attain financial freedom, but our daily decisions may hinder that vision. We have noted some of these decisions to end them hopefully.

1. Not Having an Emergency Fund

Emergencies will happen in the future regardless of how careful we are or whatever measures we take. The only way to survive them is to prepare. One decision (or indecision) we’ll regret later is not having an emergency fund when an emergency happens. An emergency is, by definition, something that takes us unawares, but to prepare for the emergency is to be aware of this potential occurrence. Emergency funds require discipline, but they can go a long way to save us when we need them most.

2. Spending Too Much Money on a Car

It might not be wise to throw so much money on a car when you live paycheck to paycheck. The car mainly serves the purpose of taking you from one destination to another. So, if you can get a vehicle that can do this and is in good working condition, that should be okay. Going for high-class cars or luxury ones shouldn’t be the goal at this point.

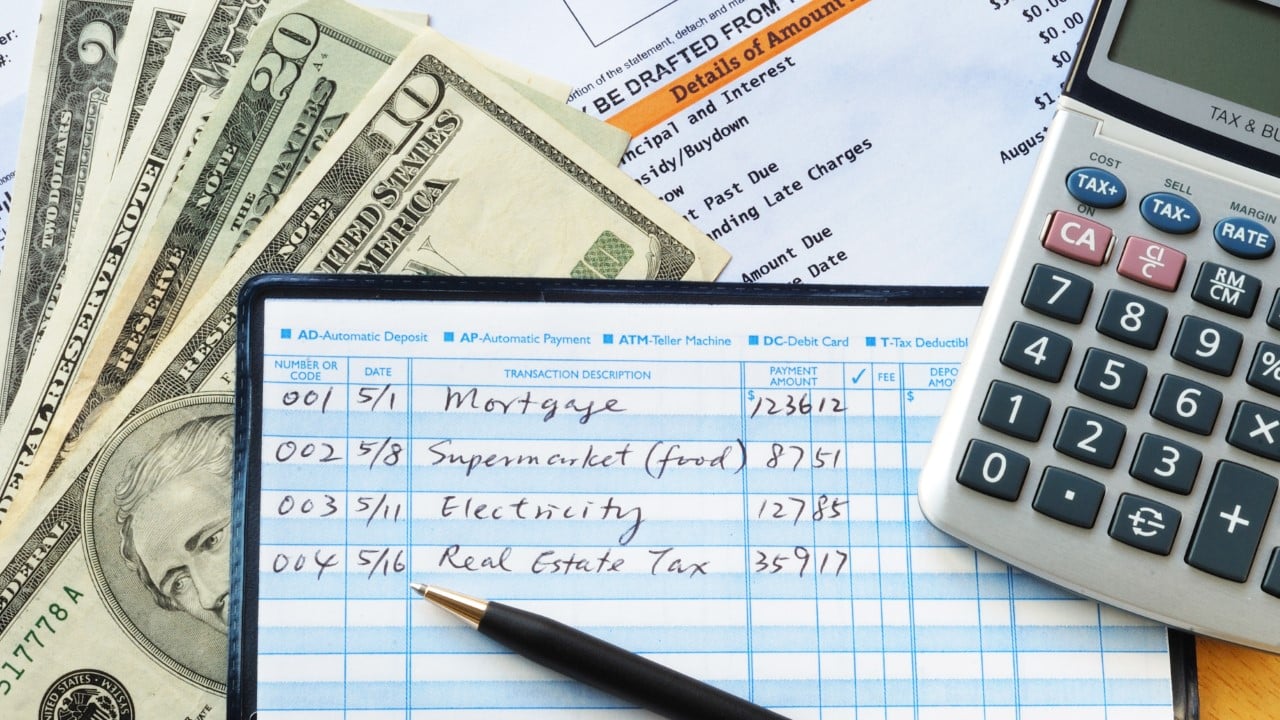

3. Not Learning How to Budget

Budgeting helps you keep track of your expenses and how much should leave your pockets. When you don’t budget, you run the risk of spending recklessly. You wouldn’t know when to put a lid on your expenses because you don’t know when you’ve spent too much. You pay for anything and buy just about anything. This lifestyle is the fastest way to go broke.

4. Buying Too Much House

Buying the house you need is good advice. Think of what you need in a house now and focus on that because it should be the only driving force behind the purchase. Please don’t buy a house because you want to impress anyone or because a realtor convinced you you can pay for it even when your pocket says otherwise. Smaller homes have a lot of advantages you can consider before buying the big one.

5. Carrying a Credit Card Balance

Credit cards can easily cause you to accumulate debt if you’re not cautious of how you use them. You have to make a conscious decision to be responsible about paying off your balance each month; otherwise, they can become high-interest charges. Credit cards are important and serve many purposes, but they must be handled with discipline.

6. Not Investing in the Stock Market

The stock market can be a significant wealth maker if you know how to use it. It can seem complex if you don’t know the rules and trends of the market, but this shouldn’t scare you off investing. Instead, you should find a professional to show you the ropes so you don’t make the wrong choices. However, the goal should be to learn enough to start investing independently. Not running away from investing altogether.

7. Not Paying Taxes

Not paying, trying to evade, or delaying taxes might seem convenient at the time you’re doing it, but in a few years to come, the problems will outweigh the benefits. These short-term fixes can lead to penalties, interest charges, and even legal action from the IRS. This behavior can cause many problems that simply paying the taxes on time would have solved.

8. Not Investing in Your Health

People often make the mistake of focusing on financial gains at the expense of their health. It would be best to remember that whatever money you make is premised on your good health. If your physical well-being is jeopardized, you can no longer chase after or enjoy anything you acquire. So, it’s essential to put your health first. Eat well, get enough rest and exercise.

9. Not Saving For Retirement

Not putting away some funds for retirement is something people have regretted. Please don’t wait until it’s too late before you start yours, whether in your 20s or 30s. You’ll be surprised how much difference the little money you save now will make in ten years. Your future self will be so grateful.

10. Spoiling Your Kids With Material Gifts

Consistently buying expensive gifts to please your kids might not be the way to go financially. You should control your kids’ spending rather than the other way around. Continuing to give in to your kids’ requests can easily throw off your budget.

11. Impulse Buying

Spending money lavishly or based on emotions can quickly lead to financial regret. Purchasing whatever catches your fancy or buying things to impress others can leave your finances in disarray. It can also lead you to debt because you might buy something you can’t afford. You must cultivate discipline and be more frugal to overcome this.

12. Falling Victim of Too Good to Be True Scams

Never being satisfied with what you have can lead you to fall victim to scams because you’ll hardly do background checks. Always remember that if a deal is too good to be true, there’s likely a scam lurking beneath the surface, and you’ll lose money if you don’t exercise some restraint.

13. Lack of Financial Goals

Depending only on paychecks without setting proper financial goals for the long term can be problematic. The paychecks might stop coming someday, and you’ll have no adequate plan to follow. Spending as the paychecks go and not thinking ahead might quickly lead to regretful decisions.

14. Contradicting Financial Views With Your Spouse

Your financial goals may prove challenging to achieve if your spouse is not on the same page as you. They may not understand your plans, and it can lead to frustrations because they wouldn’t know how to contribute to what you’re doing. Worse still, they may not see the merit in your style and disagree with it entirely. Major decisions will look trivial to them, and getting them on board will be a struggle.

15. Not Paying Attention to Recurring Expenses

If you don’t tackle your recurring expenses or add them to your budget, they can easily mess up your finances. Look out for recurring expenses that aren’t adding value to your life and consider scratching them out. Things like cable bills or data subscriptions can fall into this category. You could be paying for them even though they add little to your life.

Source: