Financial stability is more than just about how much you earn. It’s also how you manage your money. You can have a high salary and relatively low expenses, but you’re not in good financial shape if you struggle to make ends meet. If any of these circumstances apply to you, this is the perfect time to re-evaluate your money habits and develop good ones.

1. You Don’t Have a Budget

It isn’t easy to track how much money you’re bringing in, how much you’re spending, and how much you’re saving without a plan to effectively manage your money. A budget can help you avoid problems like spending too much money, running out of money, or getting into debt.

2. Your Debt to Income Ratio Is Too High

A debt-to-income ratio is the amount of outgoing payments you make when it’s compared to your monthly income. This is one of the factors creditors and lenders use to determine if your’re eligibile for credit cards and loans. If your outstanding debt is relatively high compared to your income, you’re probably having financial difficulties.

3. Borrowing Money From Friends and Family

If you have to repeatedly borrow money from friends and family to get through the month or to tide you over until your next paycheck, you’re already in a financial world of hurt. It’s time to reassess your spending habits and find ways to cut expenses and/or increase your earnings.

4. You Don’t Know How Much Debt You’re In

When you know you have outstanding debts like a car note, credit cards, and student loans but don’t know how much debt you’re in, that’s a problem. There’s no way to properly manage and budget your money if you don’t realistically know how much you owe.

5. Living Paycheck to Paycheck

Everyone looks forward to payday because that’s when they’re flush with cash, albeit briefly. But if you’re flat broke between paychecks or can’t afford to miss a single paycheck because it’ll lead to disaster, that’s a clear sign of financial instability.

6. Making the Minimum Payment on Credit Cards

Whether you have one credit card or several cards, if the only monthly payment you can afford is the minimum amount, you have a long way to go to achieve financial stability. The longer it takes to pay off credit card debt, the more you have to repay in accrued interest.

7. No Emergency Savings

It’s recommended that you have between three and six months’ worth of living expenses saved up in an emergency that results in income reduction or loss. This sounds like a lot of money, and it is, but it’s also necessary to avoid getting deeper into debt and risking damage to your credit score with late payments or falling behind in rent, mortgage, or car loan payments.

8. Maxed Out Credit Cards

Paying for purchases and bills with a credit card because you don’t have the cash will max them out quick fast, in a hurry. Unless the balances are paid in full each month, the interest increases over time, getting you deeper into debt. It also increases your debt-to-income ratio, negatively impacting your ability to receive additional credit cards and loans.

9. No Retirement Savings

It’s never too early or too late to start saving up for retirement, but the earlier you start, the better off you’ll be when you exit the workforce. The inability to set aside money for the future is a huge red flag that your finances are not in order. Social Security isn’t enough to live on, so start saving for retirement as early as possible.

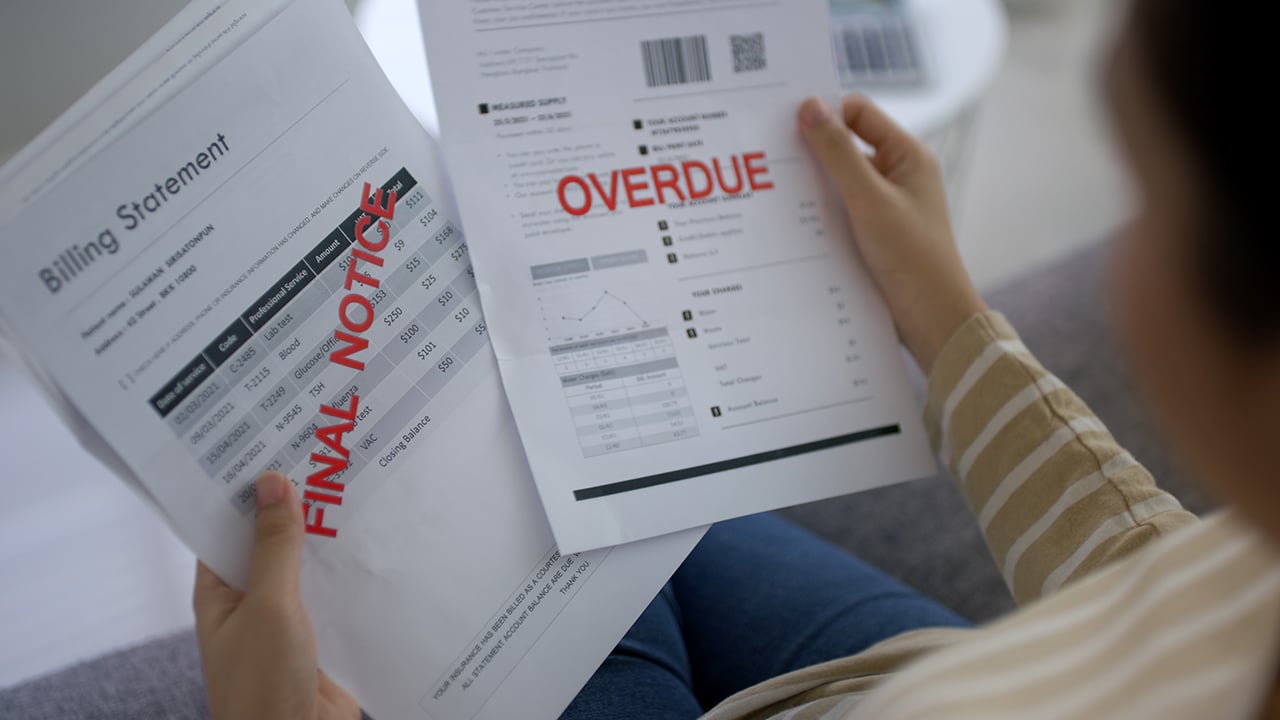

10. Unopened or Hidden Bills

Refusing to open up your bills as they come in, or even worse, hiding them from your partner so they don’t see them, is more than a red flag. It’s a four-alarm fire signaling that you’re probably drowning in debt. Ignoring your bills only exacerbates the problem and likely increases the amounts owed.

11. You’ve Been Denied Credit

Applicants for unsecured credit, like personal loans and credit cards, and secured lines of credit, like car loans and mortgages, may have their requests denied for several reasons. A debt-to-income ratio indicating excessively high levels of debt makes you a bad credit risk because of the increased chances that you won’t be able to promptly repay what’s owed.

12. Taking Out Payday Loans

It’s not unusual for consumers who don’t qualify for traditional loans because of adverse credit or a high debt-to-income ratio to take out payday loans, which are short-term loans with exceptionally high-interest rates. If you’re desperate for money to the point of considering a payday loan, it’s time to seek assistance in getting your finances straightened out.

13. Low Credit Scores

A high debt-to-income ratio, missed payments, delinquent accounts, and even having too much credit that’s in use are just a few of the factors that can negatively impact your credit score. If you’re having difficulty paying your bills on time or are not paying them at all, your credit score will reflect that. The lower your score, the harder it is to acquire credit, even if it’s a secured loan.

14. Lying or Being In Denial About Your Finances

No one wants to admit that they’re in financial trouble because it’s embarrassing and is a blow to the ego. But pretending to be financially secure when you’re living paycheck to paycheck or denying that there’s even a problem won’t change anything for the better. Facing up to your debts is the first step to paying them off.

15. You Owe The IRS

It’s a big deal to owe money to creditors and lenders. Owing money to the Internal Revenue Service is an even bigger deal that could open up a world of problems if the debt isn’t resolved. It’s also a huge sign that your financial problems are worsening and that you need to take immediate measures to address the issues causing you to be behind in your taxes.