President Joe Biden has released a $7.3 trillion budget for 2025. The proposal lays out his vision for the U.S. economy and acts as a campaign pitch against rival Donald Trump. The plan, packed with tax reforms and spending, aims to help lower-income families by taxing the wealthy and big companies more.

Tax Overhaul for Fairness

Biden’s budget includes a big shake-up in taxes, aiming at big corporations and the richest Americans to pay for his big plans. The corporate tax rate would jump to 28% from 21%.

Plus, individuals sitting on a fortune of $100 million or more could end up paying at least 25% of their income in taxes. These steps are meant to cut down inequality and fund the president’s various social programs.

Boosting Social Programs

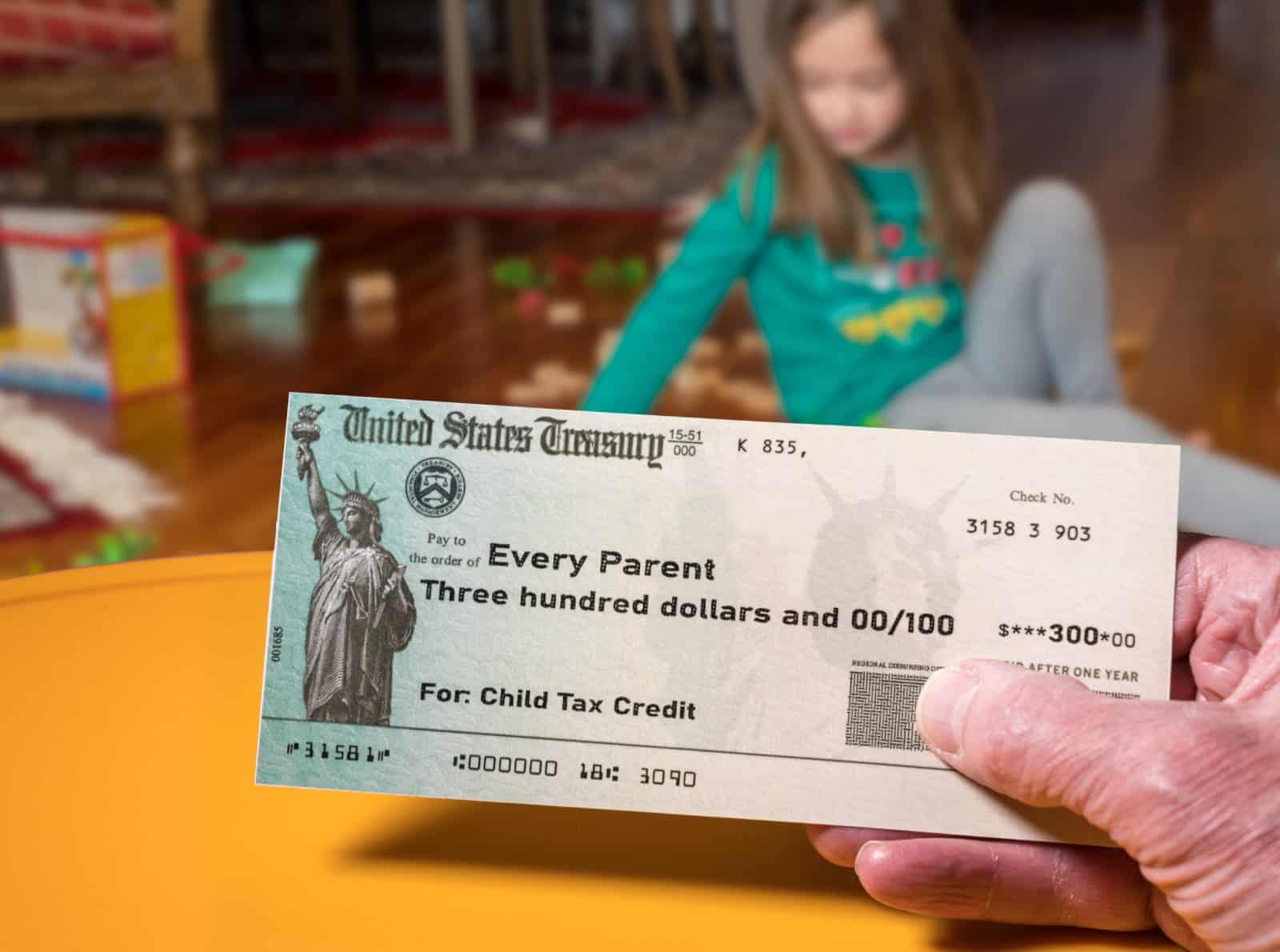

The budget aims to deliver money into several crucial areas for middle and lower-income Americans.

Key funding is earmarked to bring back the child tax credit, hefty investments in child-care programs, and a $258 billion effort for housing.

On top of that, the budget includes plans for 12 weeks of paid family leave and more money for law enforcement, showing a broad approach to supporting society.

Focusing on Deficit Reduction

Biden’s financial plan includes cutting the deficit by $3 trillion over the next ten years, aiming to deal with the huge national debt without hurting economic growth.

This plan looks to lower deficits to less than 4% of GDP within a decade, although some argue it may not fully tackle the core issues of the $34.5 trillion national debt.

Feedback from Hawks

The Committee for a Responsible Federal Budget sees Biden’s budget as a step in the right direction for tackling the deficit but says it’s not enough.

This response mirrors concerns from conservatives and deficit hawks about the need for more decisive action to control the country’s debt.

This debate highlights the ongoing struggle to find the right balance between immediate needs and long-term economic health.

Economic Growth and Inflation Expectations.

The administration’s economic growth and inflation forecasts suggest a stable economic environment under Biden’s plan.

With real GDP expected to grow by 1.7% in 2024 and 1.8% in 2025, the plan aims for a steady, if slow, expansion.

Inflation is also expected to slow down, showing confidence in the plan’s ability to keep the economy stable without triggering price increases.

Republican Pushback

Republicans, however, strongly oppose the budget. House Speaker Mike Johnson has blasted it for its “reckless spending” and “financial irresponsibility,” signaling a tough road ahead for Biden’s proposal in Congress, where getting both parties on board seems unlikely.

Economic and Political Setting

Released right after a fiery State of the Union address, Biden’s budget is a counter to criticisms of his economic handling.

With Trump focusing on tax cuts and deregulation, Biden’s strategy leans on targeted spending and tax increases to boost the economy and tackle social issues at a time when Americans are split on who has the best economic strategy.

Trump’s Economic Ideas

In contrast to Biden, Trump has suggested raising tariffs and cutting regulations for energy producers. Despite controversies over his Social Security and Medicare comments, Trump’s economic plans suggest a different path for the country’s budget policies.

The Tax Cut Debate

The argument over the tax cuts from the Trump era continues, with Democrats claiming they favored the wealthy and made the deficit worse.

Biden’s decision not to undo these cuts previously sets up a big tax policy debate for the coming year, especially as key parts of those cuts are due to end.

Impact on the National Debt

Biden’s budget aims to cut the deficit by $3 trillion over ten years, trying to control the national debt’s growth, now at $34.5 trillion.

Despite these efforts, the projected deficits and debt trajectory raise questions about long-term financial stability.

Economic Forecasts

The budget suggests a careful outlook based on modest economic forecasts, with growth and inflation predictions indicating a cautious approach amid uncertain economic conditions.

Budget as a Presidential Wish List

Given the political atmosphere, Biden’s budget is mostly a wish list of his priorities, facing big hurdles to full implementation.

The current budget standoff and resistance to spending cuts highlight the difficulties of achieving monetary balance.

Republican Strategy

A recent Republican strategy aims for a balanced budget within ten years through cuts and hopeful growth forecasts, clearly contrasting Biden’s approach and highlighting the deep ideological divide on budget matters.

Recent Budget Standoffs

Recent conflicts, including the ouster of House Speaker Kevin McCarthy and the country’s credit rating downgrade, paint a bleak picture of the budget process.

These events show the deep divisions and complicated dynamics in federal budget talks.

Looking Forward

Biden’s budget proposal outlines his desired economic future for America, focusing on helping those less affluent, aiming to reduce inequality through tax reforms, and strengthening social programs.

However, political hurdles make the upcoming negotiations a key battleground for the country’s financial and social policies.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post $7 Trillion Lifeline: Budget Boost for Those in Need first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Evgenia Parajanian.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.