President Biden has unveiled a new tax proposal targeting wealthy individuals and unrealized capital gains in the U.S. The proposal aims to address income inequality and fund veterans and mental health services.

An Economic Warcry

“Tax the rich!” A cry many of us have heard before. It’s primarily a rallying call among the ranks of left-leaning political thinkers across the USA. But it seems President Biden has finally heard and is attempting to answer the call.

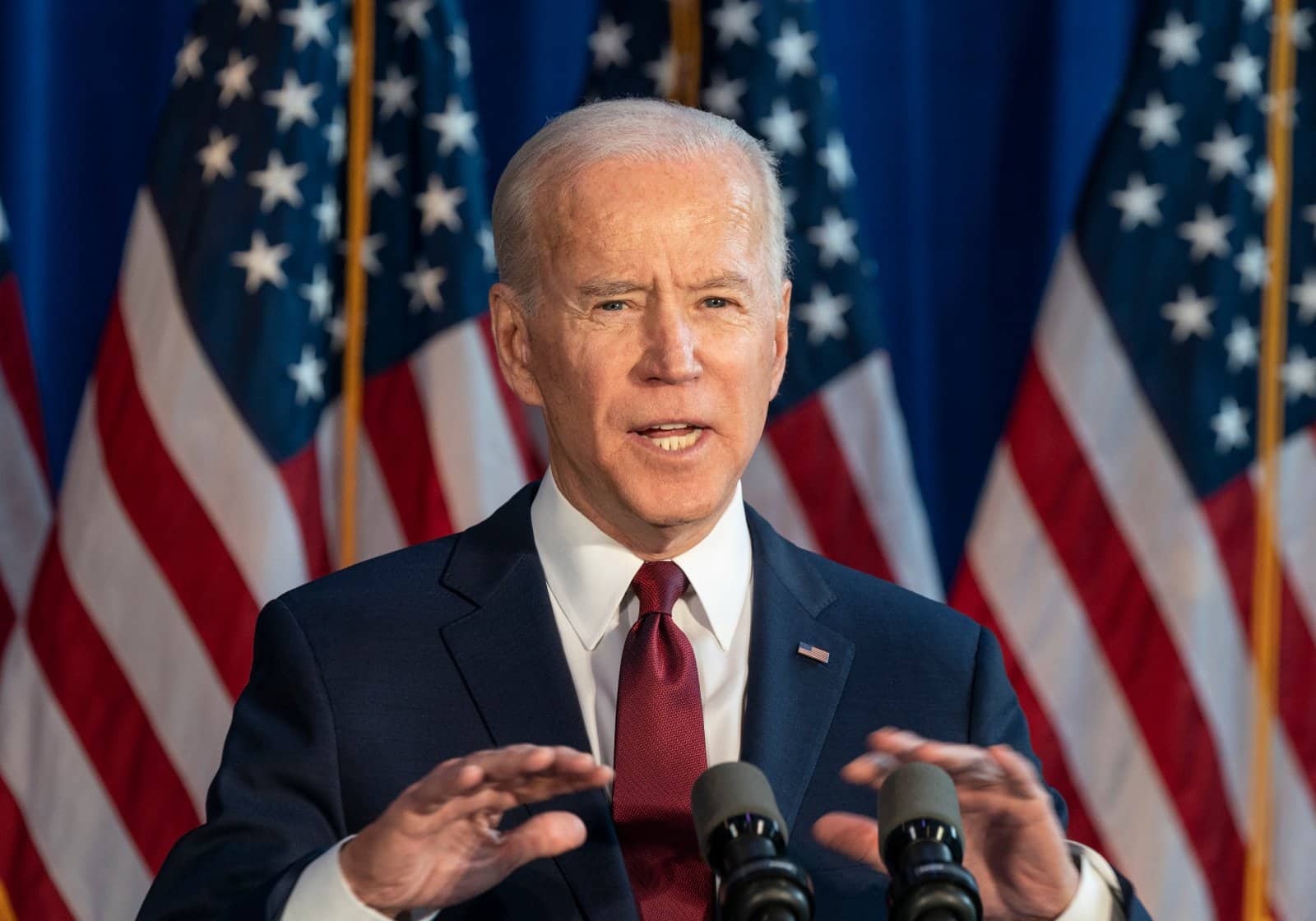

Biden’s Budget Proposal

President Biden’s answer lies in the new 2024 budget proposal. It heralds a new tax targeting what the Democratic Party calls much-needed tax reform.

Shifting Towards Equal

This tax is all-encompassing, taking into account income, investments, and other unrealized capital gains of wealthy Americans.

The intention for proposing such a change is to neutralize the upper-crust Americans’ advantage over working-class families.

Deficit to Development

An estimated $360 billion could be acquired in as little as ten years from Biden’s proposal. Proceeds will be directed towards diminishing the deficit, supporting veterans’ medical care, and developing public mental health services.

A Proposal for Presidency

When asked about the motivation behind the plan, Biden said, “No billionaire should be paying a lower tax rate than a schoolteacher or a firefighter.”

Buying Votes With Tax Reform

With elections fast approaching, many Americans are unsure who to vote for. By backing lower-income households, Biden invites endorsement from those who are on the political fence.

Most Americans Are Left Confused

With the smokescreen of rhetoric and bureaucratic jargon, it can be difficult to determine what exactly this new tax proposal entails.

A Tax On Unrealized Gains

This proposed tax deviates from standard income taxes as it carries over to unrealized gains. These gains fall into the categories of assets like stocks, bonds, and property, not solely taxable income.

This Bill Could Reshape History

Historically, U.S. tax services have been influenced to allow loopholes for the more financially flexible; Biden’s proposals aim to neutralize this advantage.

Tying Up Loose Ends

Biden’s budget offers a chance to close these tax loopholes, with a keen eye on carried interest and breaks from property gains.

What Does It All Mean

This means that potential money earned from these categories would still be taxed, even if they remained unsold by the benefactor, i.e., the financial elite.

Of course, Biden’s proposal has its critics.

Opponents of the Proposal Are Concerned

Those who oppose the plan have issues with exactly how it would work. Their top concerns are that it may discourage or inspire investors to move their practice internationally.

Former Speaker Speaks Out

Kevin McCarthy, former Speaker of the House of Representatives, said, “President Biden’s unserious budget proposal includes trillions in new taxes that families will pay directly or through higher costs.”

Former Speaker Claims “Recklessness”

McCarthy continues his statement, noting that a proposal like this could be considered “reckless.” Republican Party members hold a fear that this brash action could have unintentional consequences, preferring to play things safe.

A Democratic Demand

Those in favor, however, state that billionaires have seen an astronomical growth in wealth throughout the pandemic and should do more to aid their fellow countrymen through civic obligation.

Calls for Support

“At least he’s getting the Titanic pointing away from the iceberg,” claims Erica Payne, one of the founders of Patriotic Millionaires. Payne and her constituents believe that extraordinary wealth should not exist within U.S. borders.

More Than Just the Masses

And Payne is not alone in her beliefs. Americans across an array of demographics have spoken out in support of Biden’s announcement.

Tax Expert Weighs In

“I think if we look in the context of what American presidents have accomplished in the last 30 years, it’s a really bold vision,” says Amy Hanauer, the Executive Director of the Institute of Taxation and Economic Policy.

From Grass-Roots to the White House Lawn

While the richest U.S. citizens have enjoyed imbalanced taxation, federal initiatives like this signify a new method of weighing the scales. Grassroots concerns have now entered the legislative arena.

What Hangs In the Balance

It’s unclear whether or not the proposal will pass through Congress, regardless of scathing editing. Biden’s attempt to appease staunch young Democrats could be a political kryptonite or his saving grace, but the whole country will certainly be watching with hungry eyes.

Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

The latest Biden administration rule on 401(k) plans is reshaping how employers manage retirement plans. It’s a complex scenario requiring a fresh understanding of fiduciary duties and provider relationships. This rule aims to protect employees but also imposes new responsibilities on employers. Biden’s New 401(k) Rule: Employers Frustrated as Retirement Planning Responsibilities Shift

Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Elon Musk is calling for prosecutions after the text for a new senate bill on immigration was released. Musk accused the new bill of “enabling illegals to vote.” Elon Musk: New Immigration Bill ‘Enables Illegals to Vote’

Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

With increasing numbers of migrants arriving in Colorado, public officials have rejected any notion of the state becoming a sanctuary for migrants and asylum seekers. Colorado Officials Reject Sanctuary City Status, Warn Against ‘Dangerous Game’

Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Disney is set to appeal its refusal for a lawsuit against Ron DeSantis, who stripped the company of its rights for disagreeing with the Governor’s views on the teaching of sexual orientation in classrooms. Disney Challenges DeSantis’ “Don’t Say Gay” Rule With a Hefty Lawsuit

Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

An unprecedented surge in health plan enrollments has reignited former President Donald Trump’s commitment to dismantling the program should he secure the GOP nomination once again. Trump on the Attack as 21 Million Americans Flock to Obamacare, Biden Pushes Forward

The post Billionaire Tax Initiative: Advancing Economic Equality first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Christopher Penler.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.