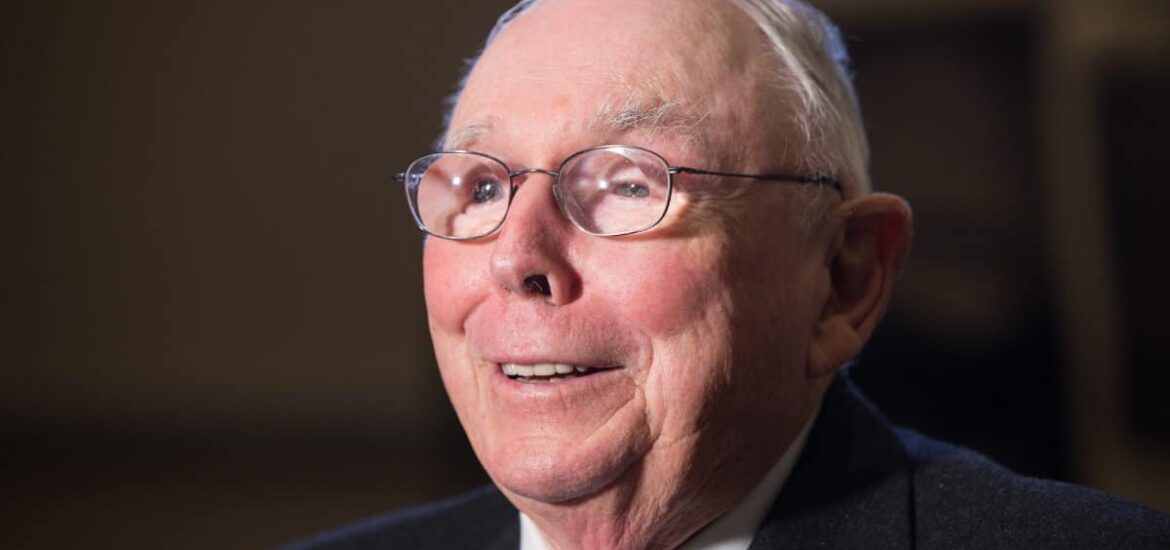

The final stock portfolio update of billionaire Wall Street investor Charlie Munger has been released by the Daily Journal, giving some insight into his winning approach to investing.

Final Portfolio Update

The newspaper publisher Daily Journal has just released the final stock portfolio updates of Charlie Munger, who built an impressive reputation as a Wall Street investor and philanthropist over the last half-decade.

A Prestigious Reputation

Munger was the right-hand man and business partner of renowned businessman and investor Warren Buffet, the vice chairman of Berkshire Hathaway, and the chairman of the Daily Journal for 45 years.

His Legacy Continues

Sadly, Munger passed away on November 28, 2023, just 34 days before his 100th birthday. But his legacy as a savvy investor and former attorney is unlikely to be forgotten any time soon.

Munger and Daily Journal

One of the foremost achievements of his career came about under Daily Journal – when he expanded their stock portfolio from zero dollars to $300 million in 15 years, so his portfolio updates for the company are highly sought after.

2008 Financial Crisis

The 2008 financial crisis devastated the Daily Journal, so the chairman proposed to take over its investments by diverting company cash into stocks.

First Filing

His first portfolio filing was made in the first quarter of 2013 when the value of the Daily Journal’s holdings had hit the $100 million reporting threshold.

Three Winners

By this point, the publishing company owned over a million shares in both Wells Fargo and Bank of America respectively, and over a hundred thousand shares in US Bancorp.

Holding for a Decade

As of December 30, 2023, the Daily Journal stock portfolio update managed by Munger held the exact same amount of shares in all three companies as it had a decade earlier: 2.3 million in BOA, 1.6 in Wells Fargo, and 140,000 in US Bancorp.

Few Changes, Big Rewards

During those ten years, the value of the Daily Journal stock portfolio tripled, yet their chairman and portfolio manager had made very few changes or adjustments in that time.

A Shrewd Investor

Munger’s decision to leave the portfolio virtually untouched for a decade is a supreme example of his investing style – and his emphasis on patience and discipline.

Careful Consideration

But that’s not to say that Munger did nothing with the portfolio during those years. Though he seemed to value a “set and forget” approach to investing, he did make alterations that yielded both positive and negative results.

Cutting Back in Some Places

In 2013 Daily Journal also held 64,600 shares in Posco, a South Korean steel manufacturer. However, in the fourth quarter of 2014, Munger cut those shares down to 9,745, a number that remained untouched until 2022, when they exited the holding.

Investing in Ali Baba

Another significant change came in the form of Alibaba. Munger bought shares in the Chinese e-commerce company at the beginning of 2021, when it was near its peak.

Changing His Mind

In the fourth quarter of 2021, he quadrupled the Alibaba shares. But for some reason he thought better of this decision, turning his back on the brand and halving the wager in the next quarter.

Missed Opportunities

His decision to keep those three holdings static in BOA, Wells Fargo, and US Bancorp may have been ultimately reliable, but other opportunities were still missed.

Minimal Growth

Over that decade the Daily Journal’s shares in Wells Fargo and US Bancorp grew by less than 10%. Over that same period, the S&P 500 rose by a jaw-dropping 150%.

Winning With Bank of America

Fortunately, their investment in Bank of America made significant improvements relative to other holdings during that time. In 10 years, their stocks rose to nearly 120%, making up for the somewhat lackluster returns elsewhere.

His Skills Were Undeniable

Despite the minor downsides, it’s undeniable that Munger was an expert investor, barely touching a portfolio for 10 years and yet achieving a $200 million profit in that time.

A Glimpse Into His Mind

This new stock portfolio filing by Daily Journal gives outsiders an illuminating glimpse into his investing style, showing a commitment to placing careful bets with an eye for the long term and avoiding the urge to panic sell or make too many changes.

Their Portfolio Will Never Be the Same

And just two months after his passing, it’s clear that the loss may have a devastating effect on the Daily Journal portfolio’s longevity. The publishing company has even warned its shareholders that “given the loss of Mr. Munger, the Company does not expect the future financial performance of its marketable securities portfolio to rival its past performance.”

More From Frugal to Free…

U.S. Budget Breakthrough: A Huge Step Forward Amidst Looming Shutdown Threat

Will Easing Inflation in America Continue?

The post Billionaire’s Winning Approach: Charlie Munger’s Last Stock Portfolio Update Revealed first appeared on From Frugal to Free.

Featured Image Credit: Shutterstock / Kent Sievers. The people shown in the images are for illustrative purposes only, not the actual people featured in the story.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.